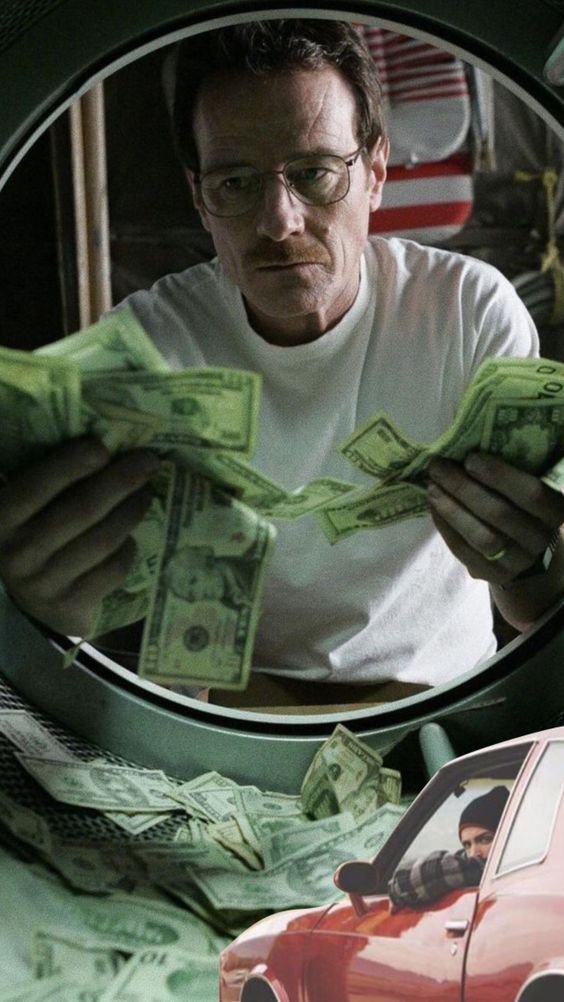

How Many Business Bank Accounts Should You Have?

Having one bank account can get messy. You need buckets. Here’s the breakdown of the accounts you need to get organized with your business(es).

Income Account - All money flows through this channel. Use this checking account to funnel out to the other accounts at the end of the month.

Tax Account - Set aside 20-30% of your income (ask your CPA) for when the tax man comes.

Operating Expenses - It takes money to make money. This account is used to pay out all the operational costs you may incur within the business.

Payroll/Owner’s Comp - After operating costs are paid, ensure the team gets paid out.

Savings/Profit Account - Dividends get paid out to owners at the end of the quarter for some businesses. Rack up 3-6 months here too, so you can dip in if there’s an emergency.

Dividends / Investments - Not every business does this, but it sounds like a pretty bright idea. It can either be blended with a savings/profit account, or it can serve as its separate investing account. $$$$